Punch Industry(TYO.6165)

Net-Net, Dividend 5%, Alliance with Misumi(TYO:9962) will bring a survivor' profit.

Summary

Business : Mold components

Valuation : Net-Net, PBR=0.5x

Dividend: 18 yen (FY2025 forecast), expected dividend yield = 5%, expected payout ratio = 275%

Future Catalyst : Aligning with Misumi(TYO:9962), Factory Automation business expansion, Gaining survivor's profit.

Risk : China slow down, Substitution threat(e.x 3D printer)

My Position: Holding (average buy price = 366 yen)

Business Analysis

Understanding at a glance

What does Punch Industry do?

Punch industry produces mold components. Their main customers are mold maker. Overall mold market grew over years due to the manufacturing production increase, supply chain standardization, etc.. (*Some report shows the recent CAGR is 7%. Link)

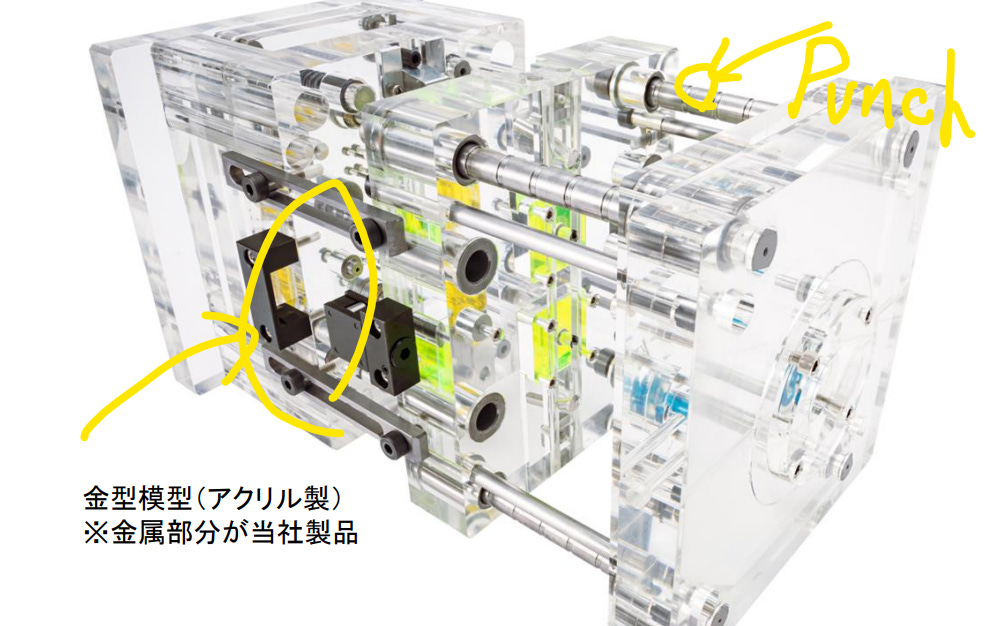

*This is the mold prototype. Yellow highlighted metal parts are Punch products. “Punch” is the one of the mold components, which is the company name.

Punch early started business in China, they are the No.1 position in this field in China. Looking the sales by regions, China is the biggest part. Also, China sales grew up +14% in FY2024.

*Link

For the world market share of mold components, Misumi(TYO:9962) is the top share. Punch is the second. Almost all Misumi products are standardized one, which are purchased on EC channel. While Punch products are customized one based on the end use marker request. So Punch’s EC channel ratio is less than Misumi. Of course Punch also produces standardized products, but considering Misumi doesn’t produce customized products, Punch and Misumi business are seperated to some extent.

Except for Covid-19 period, mold market is stable growth, so Punch business performance stays profitable for many years.

*Gray line : Revenue, Red line : Operating profit.

Looking into the earning, the value is decreasing compared to operating profit. Forward PER is 57x. But it because special loss is included due to the restruction of factory to achieve an efficiency, so Adjust forward PER is 12x, calculated by operating profit basis.(*special loss is one-off event.)

For the future outlook of mold market, they estimate a stable growth.

*Link

Also, Punch tries to expand FA(factory automation) business. Based on the high demand of robotic automation, the company estimates that FA market will continue to grow. Applying the technical asset of customizing mold components, they try to expand especially for customized FA components.(*For standardized FA components, Misumi takes a large market share in this industry. As well as mold components, Punch and Misumi try to separate their FA business segment.) Considering the current valuation, the market has no valuation for the future growth of FA business.

*Link

*FA revenue will grow at CAGR 12% from FY2023→FY2026.

Capital & Business Alliances with Misumi

The alliances with Misumi(TYO:9962) was announced in 2024. They will purchase raw materials jointly, share the assets each other such a logistic and factory. Misumi has a sophisticated EC channel. Punch’s customized products will be sold in this EC channel. This alliance was achieved, because their business is separated which means Misumi produces standardized products and Punch produces customized one, they can seek a synergy. *Link

As mentioned above, Misumi is No.1 position in mold components market, Punch is the second. This alliance will show the strong get stronger due to the more efficient capital expenditure, which results in SME exit from market. Punch will gain a survivor's profit.

Valuation

Based on the latest financial position in FY2025 Q4, it’s Net-Net stock.

Calculating “Cash to distribute for shareholders“ + PER valuation, I use the operating profit, not net profit including the special loss. The current margin is not high, but if Punch achieve the growth based on stable mold components market and expansion of FA business, the current net profit(adjust) used in this valuation model is conservative, which has the future upside.

Shareholder Return

The latest expected dividend is 18 yen with a yield of 5%. Punch applies for DOE 3%, which expects stable dividend.

*Link

Note that why the latest dividend will decrease 20→18 even though DOE policy.

It is because the number of shares increased in 2024 due to the alliances with Misumi. They announced Misumi and Punch have their shares each other. So, Punch issued the new shares. Now, Misumi has 10% shares of Punch. (*Currently, they explain there is no plan for merger integration between Misumi and Punch.) Increasing the number of shares, dividend per share decreases.

Dividend yield 5% is enough good for me. I wait for the future catalyst, such as business growth, dividend increase, M&A by Misumi(Maybe? Not sure), while collecting the decent dividend.