SEC Carbon(5304)

Super niche top business, Positive macro trend will support in coming turnaround, Net-Net, Dividend over 4%.

Summary

Valuation at a glance (AS of Jan 6, 2026)

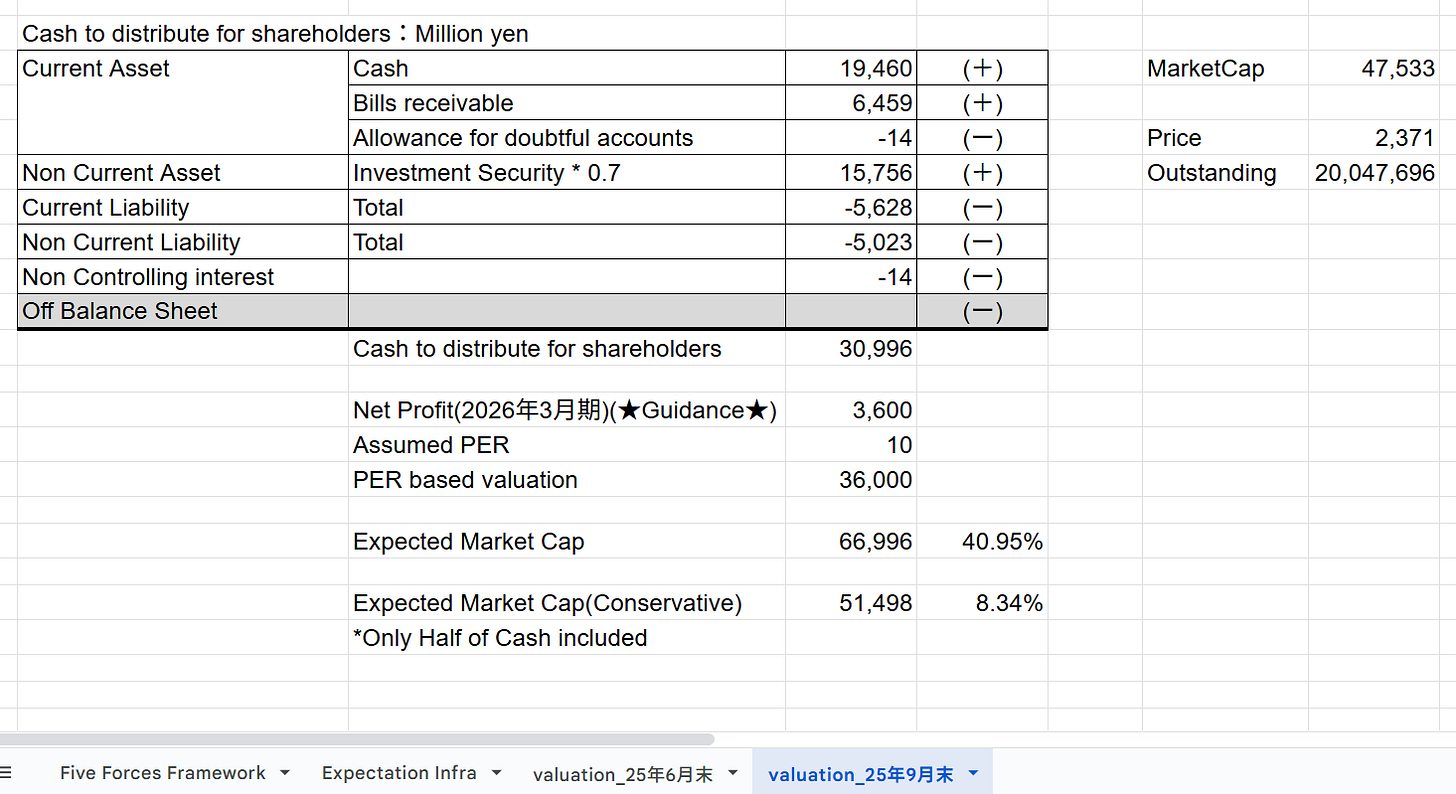

Current Market Cap = 47,500 million yen(303 million US$)

Current Share Price = 2371 yen

NCAV/Share = 1,724 yen

(NCAV + Investment Security)/Share = 2,509 yen : Net-Net

PBR = 0.6x

PER = 13x (FY26 guidance)

Dividend 4.3% (FY26 guidance)

Why this stock idea is interesting?

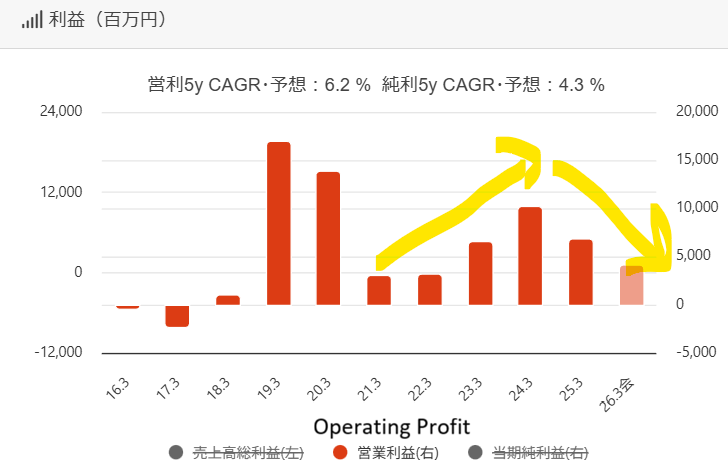

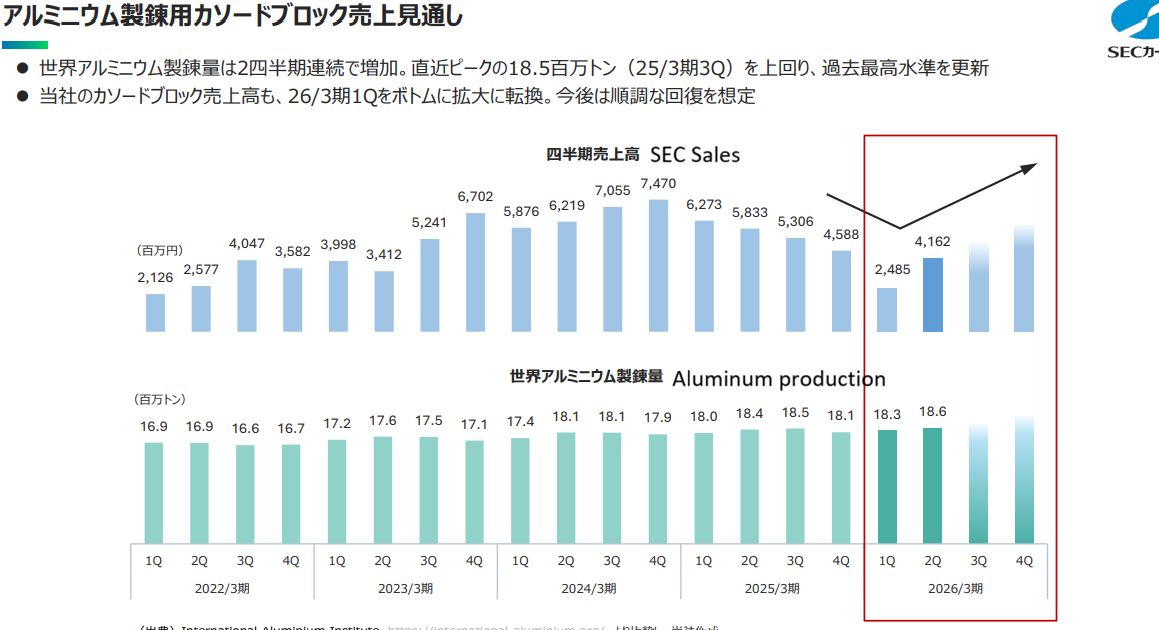

Temporary setback now & Turnaround will be soon : The company main product is used for aluminium production. Currently, the aluminium manufacture has decreased purchasing SEC Carbon product, because they already have a inventory. This is the reason why SEC Carbon business performance is weak in FY2026. However, considering overall trend of aluminium production is steady growth, the aluminum manufacture will re-start to purchase again soon. SEC Cardon has increased CapEx in current difficult time to capture the demand in coming recovery trend. According to the company forecast, the recovery process will start from next fiscal year FY2027. If it’s true, the company net profit will be double in the next few years. For current valuation, PER is 13x, Net-Net, I believe the market underestimates the turnaround of business. Moreover, dividend yield is over 4%, which is enough for me to wait the turnaround while collecting dividend.

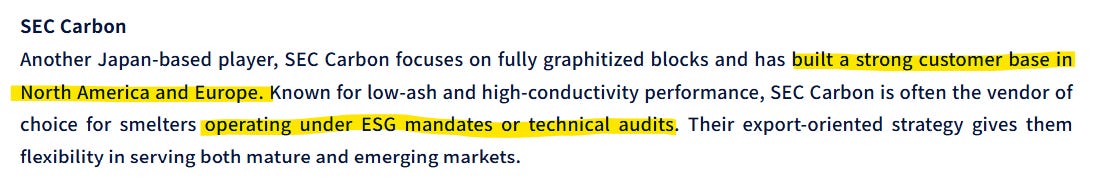

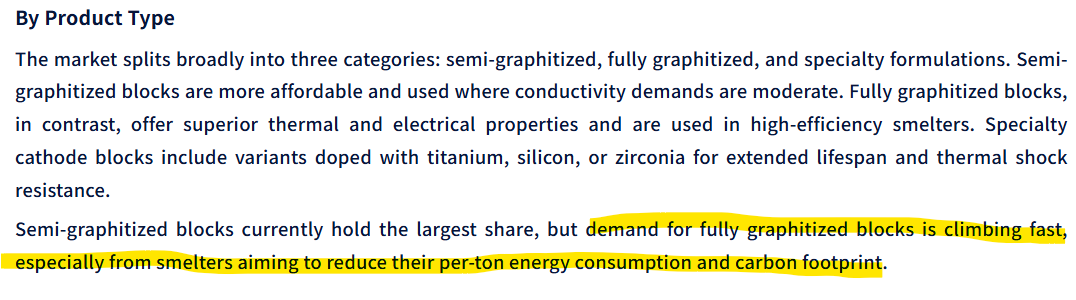

Business

SEC Carbon provides carbon products. Their main product is "Cathode carbon block for aluminum smelting”, which accounts for 80% overall sales. The main characteristic of their carbon block is graphitization by using carbon product. When aluminum smelting, high energy is consumed. Graphitization cathode block is high quality for less energy consumption, which is strong point for more strict environment regulation market, such as America, Europe. For more details, please refer the company site. (Link)

Looking at the market share for cathode block for aluminum smelting, SEC Carbon is 40% global market share except for China. So, SEC Carbon is the main player in this super niche area. For 50% remaining, it’s Tokai Carbon(5301). Considering oligopolistic market, it seems the intensity of competition is limited. Of course, Chinese company is competitor, but their main market is China, which is the biggest aluminum production area. Although China has a price competitiveness, overseas customers especially for high technology standard, such as America, Europe, Middle East, wants more high quality product. Furthermore, there exists geopolitical issue with China. That is why global market share except for China is dominated by Japan now.

Investment Thesis

Why the current business performance is weak?

“Cathode carbon block for aluminum smelting” is used for aluminum smelting. In this process, cathode block wears out, then it’s replaced in a few years. So, SEC Carbon business has a cyclical perspective. After COVID19, overseas aluminum manufacturers increase inventory of cathode block in the past years. Currently, they remains the inventory. That is why SEC Carbon business is weak now.

Where is the revival story?

Obviously, the business depends on aluminum production. According to the data, the production volume has a steady growth. Which means the overall tread is not bad for SEC Carbon. Aluminum manufactures will re-start purchase cathode block. Looking at the quarterly sales, it seems the current weak result is bottom and turnaround will be soon.

Not only just cyclical perspective, but there is a positive change for SEC Carbon. It’s increasing demand of fully graphitized blocks. As mentioned in business part, they produce high quality of graphitization cathode block, which is less energy consumption and extends lifespan of aluminum production facilities(Link).

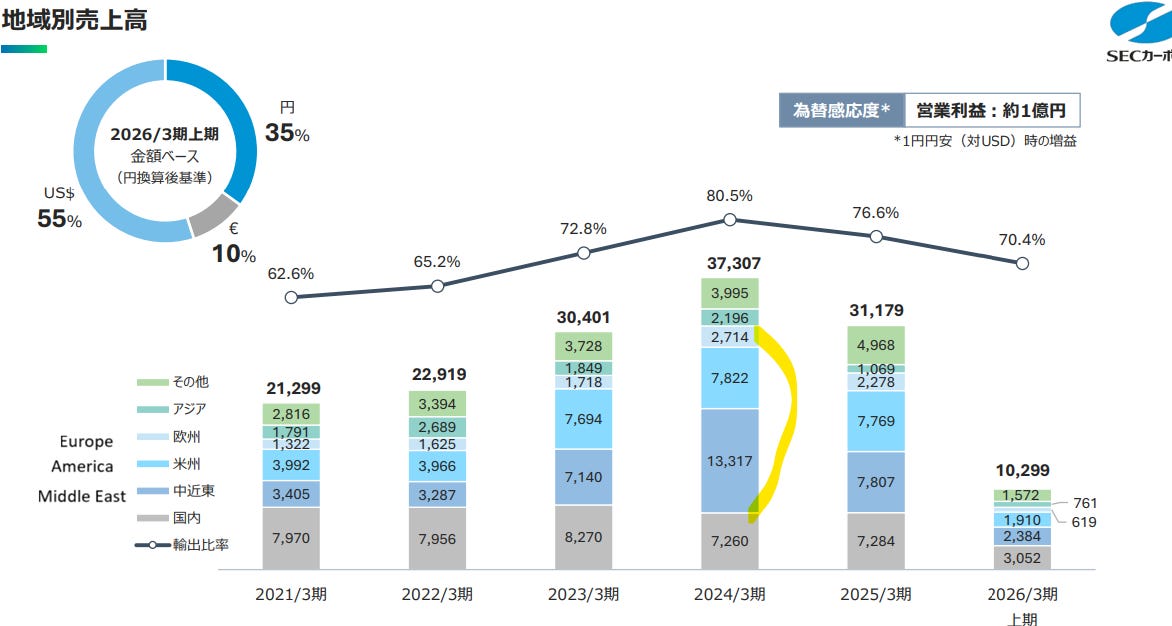

Looking at the sales regions, SEC Carbon get orders from Middle East, America, Europe in which they have a high technology production facilities and seek more energy efficient from eco-friendly environment perspective. They want to high quality cathode block from SEC Carbon.

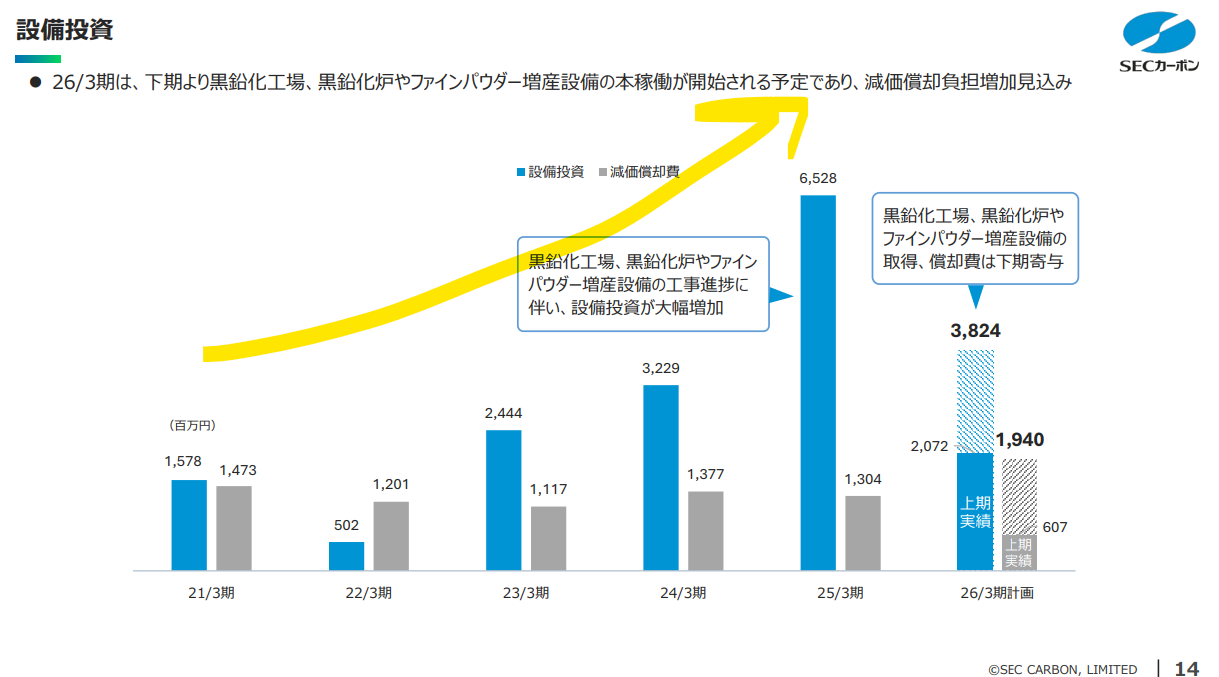

To capture the future demand, SEC Carbon has increased CapEx. In the next business cycle, I expect sales growth by expanding market share and margin improvement, due to the increasing demand of high quality cathode block.

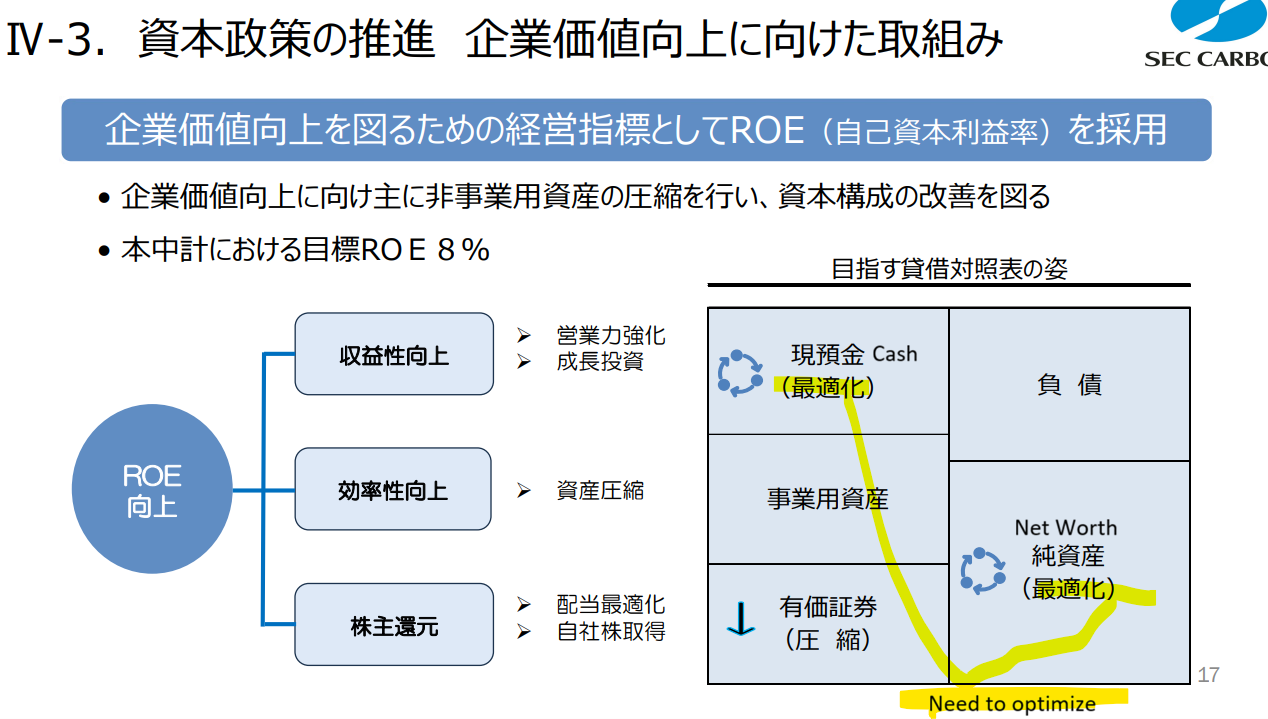

Finally, let’s check shareholder return. The current dividend yield is 4.2%. The company has many cash 19.4 billion yen, so current dividend payout has no problem. Also, considering the recent payout ratio is just 30%, I expect there is a room of more shareholder return. The company understands they need a better capital allocation.

This investment thesis is basically cyclical play. The difficult point is when turnaround starts. I think it will start from the next fiscal year FY2027. However, not sure precisely. But, I can get over 4% dividend even if turnaround takes some time. This is advantages to invest cash-rich, Net-Net stock.

Valuation

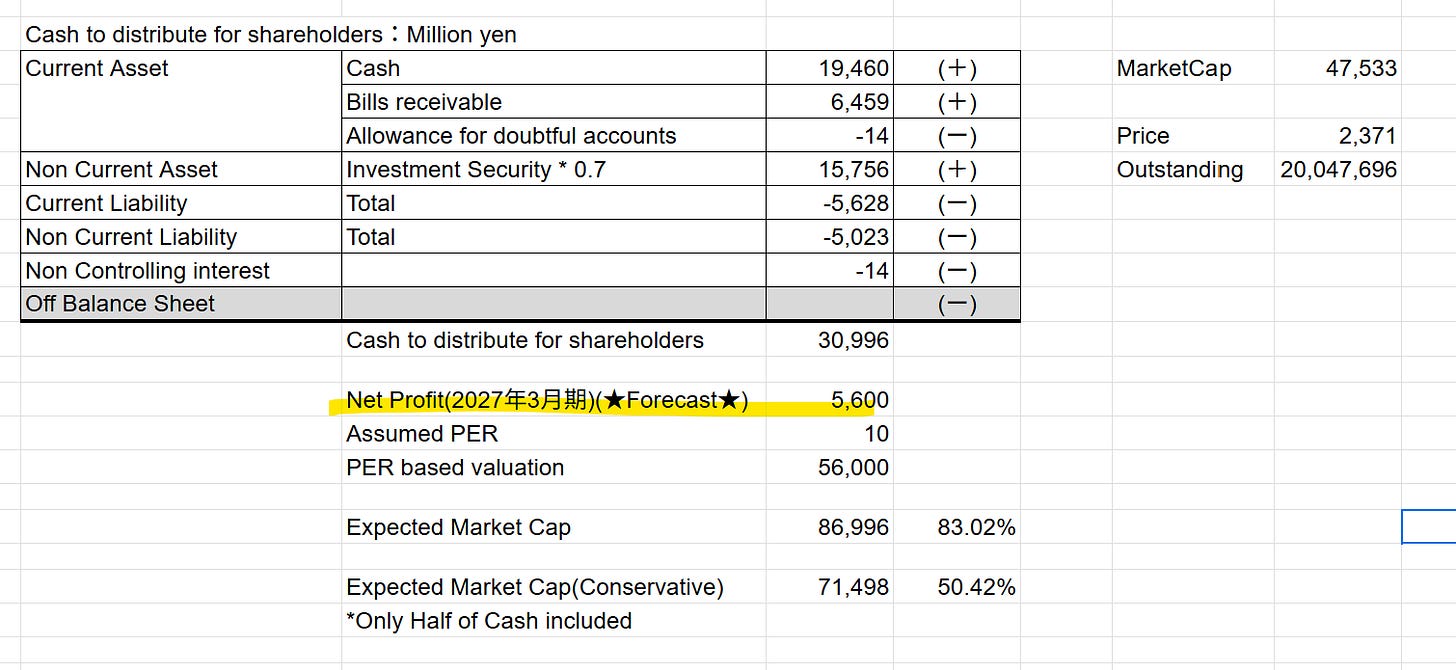

As usual, Net Cash + PER valuation. This model shows the current price has a theoretical upside 8%~40%. For the conservative purpose, I exclude inventory from Net Cash calculation. This rule applies for all my covered stocks. If you want to include it, please adjust the model.

This number is based on the current weak business performance. If the turnaround materialized, how does valuation result change? According to the mid-term management plan(Link), the company forecasts operating profit 8,000 million in the next fiscal year FY2027. After tax deducted, the upside will be 50%~83%.

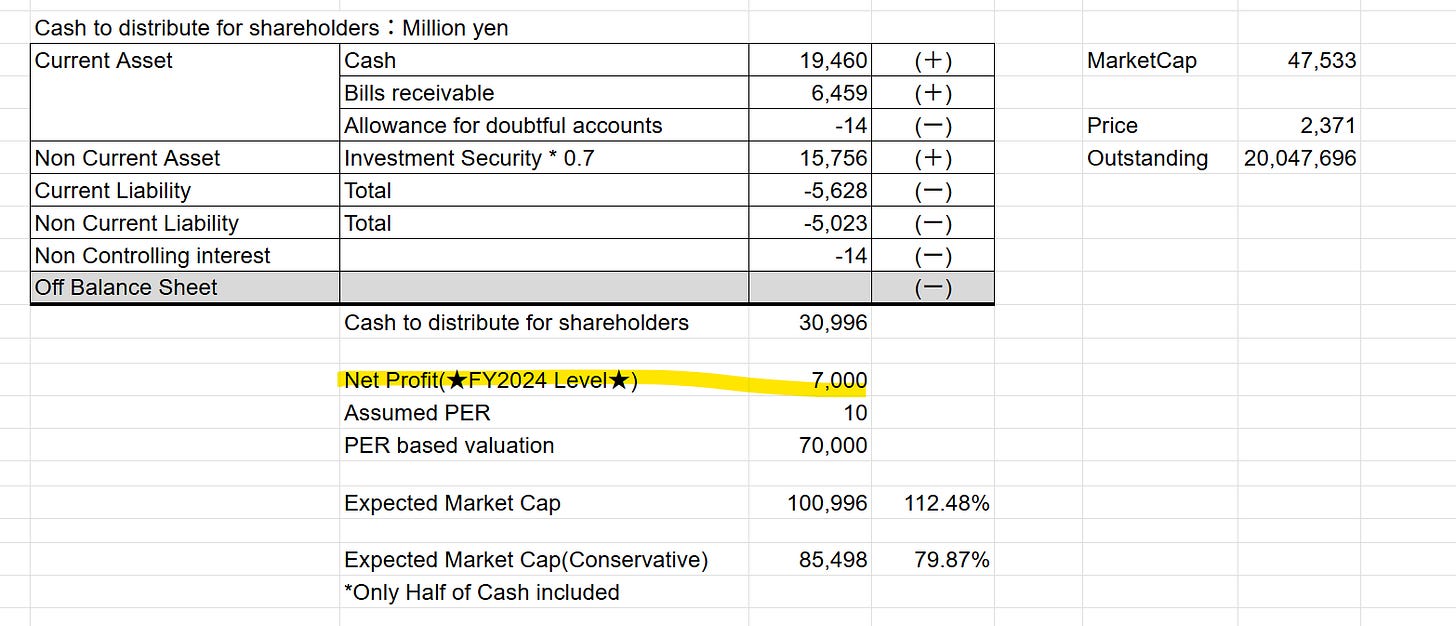

If the business recovers to the past FY2024 level, the operating profit will be 10,000 million. The upside will be 79%~112%. Moreover, as mention previous part, there is possibility for SEC Carbon to achieve more growth, due to the trend of seeking fully graphitized blocks.

Fair valuation depends on your discount rate and timeline for turnaround. However, I believe the current valuation is cheap enough to open the long position.

Risk

Delay of recovery cycle of purchasing cathode block.

Fierce competition with Chinese company.

Final note. This report was written yesterday Jan 6, 2026. But unfortunately, I notice the stock price is up over 5% now today Jan7. Not sure why. There is no news now. This is usual price action for Japanese small cap. Anyway, if you consider to buy this stock. Please consider carefully when to open your position.

Disclosure : I hold a long position in this stock. My report is not investment advice.

Hi there , I traded in my PPE and tools and now I'm new to Substack. I write about markets, risk, and the stories we tell ourselves to stay comfortable. After the Close focuses on process over prediction, discipline over drama, and thinking clearly when the screens go dark. Appreciate a review of my process. Good or bad I can handle it. - Andrew