Wavelock(TYO.7940) : FY2024 Q4 Earning Update

Growth Story of Advanced Technology is still solid, Forward PER 8x, Dividend 5.3%.

*I’ve already published stock analysis report for Wavelock(TYO: 5819). If you’re interested, please check it out.

Wavelock announced FY2024 Q4 earning update in 2025/05/09. (Link)

The annual result was almost in line with the guidance. Operating Profit of ‘Advanced Technology‘ increased by +191.4%. This segment is the growth factor, so we need to watch their business progress. Although the actual sales/operating profit was short on their guidance, ‘Advanced Technology‘ is getting on the growth path.

*Link

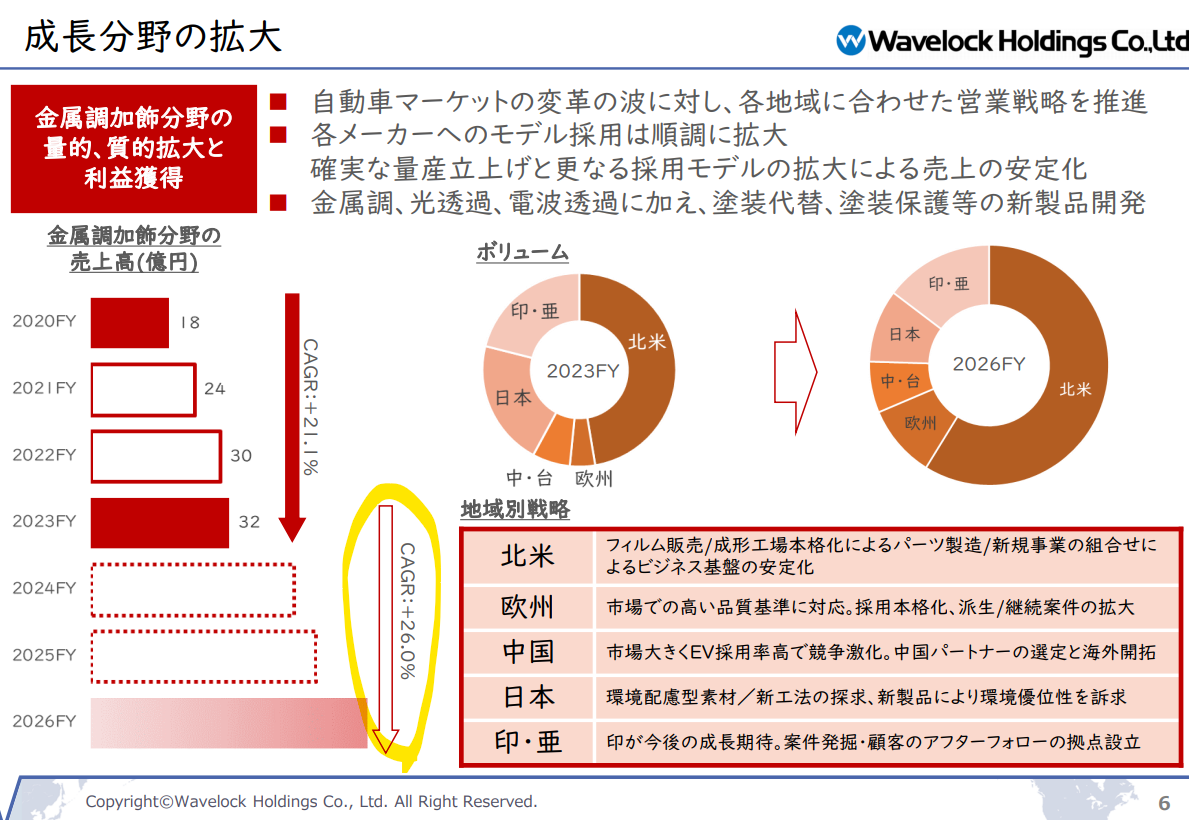

Let’s look into ‘Advanced Technology‘ result in details. There are some fields in that business segment, ‘Decoration & Display‘ is the most important, which is business of metallic decorative film for automobile industry. Others fields are just purchase-sell business, which is mediocre, almost no profit impact. Despite the overall sales growth of ‘Advanced Technology‘ was just 4.3%, ‘Decoration & Display‘ was up 22.8%, which drove the high operating profit growth.

The guidance FY2025 which Wavelock provides assumes sales/profit growth in both "Materials Solution" and ‘Advanced Technology‘.

For "Materials Solution", the company will rationalize the product price so that operating margin is improved. Considering the basic material(naphtha) price calms down, it will support the improvement of "Materials Solution" margin.

Next ‘Advanced Technology‘, the assumed growth of operating profit is +138.1%. As mentioned above, it depends on the growth of ‘Decoration & Display‘ field which makes almost all profit in ‘Advanced Technology‘. What is the assumed sales growth rate of ‘Decoration & Display‘? It it not disclosed in the company materials. If the operating leverage(191.4/22.8 = 8.39) is the same as last year, the expected sales growth rate in this year is 16.46%(=138.1/8.39) based on the disclosed operating profit growth rate +138.1%. Of course, the actual (fixed)cost structure is not sames as last year, so this calculation is a rough estimation. Actually, Wavelock increased investment in ‘Advanced Technology‘ last year as well, so depreciation cost will be up in this year, which assumed sales growth rate might be higher.(20%?) Considering the last year growth rate is 22.8%, the growth will get slow in this year. However, it’s not bad number based on the current automobile industry situation faced with tariff issue.

*In the mid-term management plan, the company assumed the sale growth rate of ‘Decoration & Display‘ is CAGR 26%. Based on above estimation 16.48%, assumed growth track gets slower. It’s inevitable due to tariff issue… (Link)

Due to uncertainty of US markets, the company tries to expand China and India. In China, Wavelock product was adopted in BYD. In India, it has been adopted Tata Motors and Mahindra & Mahindra. This trend will drive the growth in Asia region. Especially, BYD is producing more and more cars amid the trade war, which is the positive sign for Wavelock.

*Link

How about US market? Not sure. The company thinks so too… In this guidance, tariffs impact has not been included because it’s difficult to calculate at this time. Wavelock product is already adopted in US carmaker(ex. GM) and Ohio factory is operating to sell their product to US carmaker. If the number of car production will be shrank significantly, it will have a negative impact on Wavelock business in US.

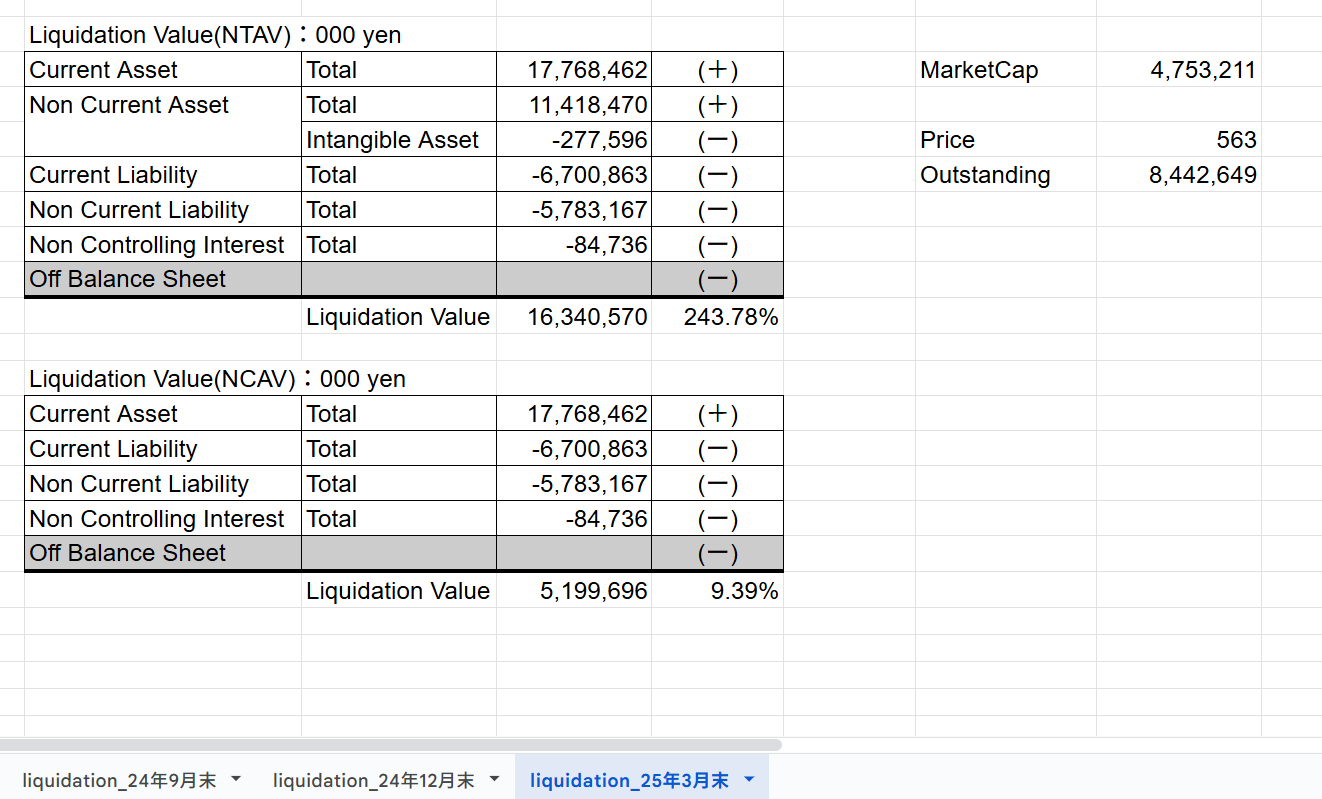

After Trump tariff was announced, Wavelock price fell on 20%. It because the Market thinks that tariff has negative impact on Wavelock business especailly for ‘Advanced Technology‘, which will make their next year guidane worse ignificantly. Yes, tariff is not good for Wavelock, but the diclosed guidance seeems not bad. Now forward PER is 8x. Considering the growth opportunity is still solid, I believe Wavelock is undervalue share. Furthermore, FY2025 expected dividend is same as last year, 30 yen, which expected yilds is 5.3%. It’s enogh high dividend. Also, it’s still Net-Net stock.